The majority of American workers dream of having a comfortable retirement and having enough funds for their golden years. In reality, thousands of people have trouble reaching this aim due to the way the U.S. retirement system has changed. They aren’t offered pension plans but 401(k) plans and other retirement accounts instead.

These options put more responsibility on employees rather than recruiters, so not all workers have access to retirement plans. Here is why more employees need access to retirement savings and what you should do if you aren’t offered an employer-sponsored retirement plan at work.

Reasons Why Not Everyone Has Access to Retirement Plans

Public and private industry leaders came together on Thursday in Washington, D.C. They gathered at an event hosted by the Employee Benefit Research Institute to define options to help employees prevent financial shortfall. Some leaders stated that pension plans used to help consumers feel financially secure when they retired.

Having a retirement plan is considered to be a vital component of a decent job, as millions of Americans don’t have this future security in terms of their retirement. Plenty of them has no retirement savings either. When it comes to urgent financial disruptions, they may opt for the best credit card for cash advances or take out a personal loan. It is the smartest way to use a credit card in such situations.

However, when it comes to retirement, they feel insecure while thousands of employees are approaching the end of their careers. This situation is even worse for people of color, as only 30% of Hispanic families have retirement savings, and 36% of Black households ages 55 to 64 have certain retirement savings. Thus, it is a real problem that needs to be solved in the USA.

Ways to Make Retirement Savings More Accessible

The main reason why so many Americans feel insecure as they are approaching retirement is that they don’t have enough savings to spend their golden years in comfort. They aren’t saving enough because they have no opportunities for that rather than having no desire to save.

People are often told they need to think about their retirement and save for it, but they also have a lack of access to options on how to save for their retirement. Sixty-five percent of small business workers don’t have any retirement plans. Here is how to increase your access to a comfortable retirement.

Boost the Saver’s Credit

One of the solutions is to increase the saver’s credit. It is aimed at cutting taxes by up to $1,000 for single workers and $2,000 for married people when they make contributions to a retirement fund.

Such people should be from low- or moderate-income households. This provision is also called the Retirement Savings Contribution Credit. The credit sum is 10%, 20%, or 50% of the contribution to retirement accounts. This amount depends on the AGI of the worker.

Submit Form 8880 if you want to claim this credit when you file your taxes. As Tax Day is approaching soon, you may take advantage of this opportunity. If your income is from $21,750 to $32,625, you may claim up to 50% of the credit for single employees.

Auto-Enrollment

According to some experts, another suitable way to boost equity in retirement is to utilize auto-enrollment in your sponsored savings plans. What is the definition of auto-enrollment? It is the process when companies enroll workers in their retirement plans automatically.

Employees should be offered default plans for retirement income, as about thirty percent of low-income consumers don’t have any retirement savings at all. Seventy percent of recruiters having at least 1,000 employees had auto-enrollment plans at the end of 2021.

Offer Retirement Plans Easier

Some financial experts believe that government laws, together with private recruiter benefits, can make it easier to save for retirement. We should move the SECURE Act 2.0 through Congress as it will encourage companies to offer comfortable retirement plans to employees.

This Act is a revision of the 2019 bill that was aimed at offering part-time employees access to retirement plans. Low-income households will benefit from the SECURE Act and be able to save funds for the future.

Retirement Benefit Access and Participation Rates

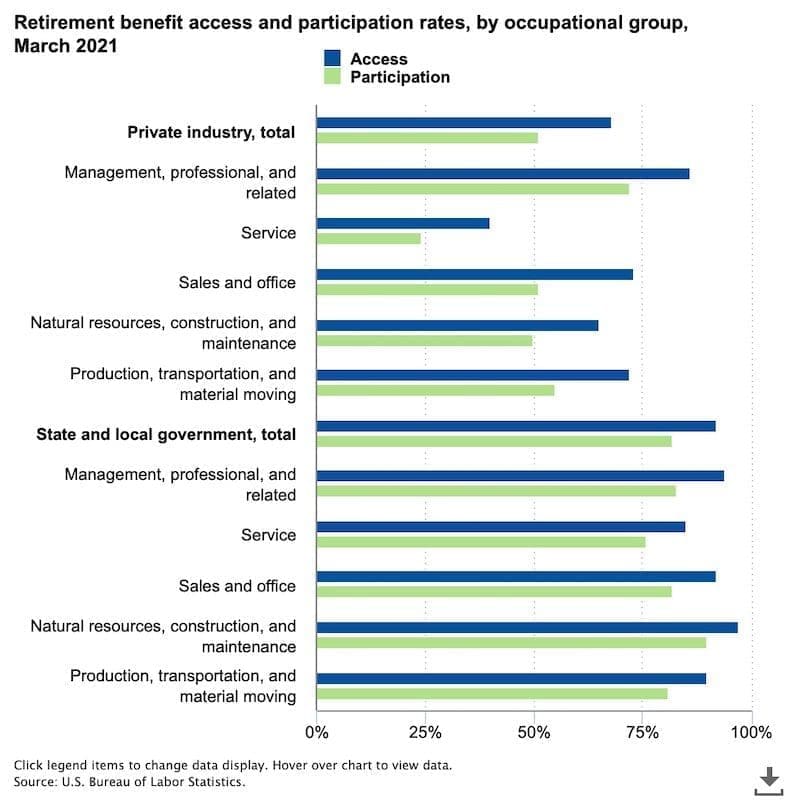

The chart on retirement benefit access and participation rates published by the U.S. Bureau of Labor Statistics shows that 68 percent of private industry workers had access to retirement benefits through their recruiter in 2021, with 51 percent taking part.

Access to retirement benefits was granted to 92 percent of employees in state and local government, with 82 percent participation. Service workers had both the lowest access rate (40 percent) and the lowest participation rate (59 percent). As we can see, not all workers have access to retirement plans through their employers.

What You Should Do If You Aren’t Offered an Employer-Sponsored Retirement Plan

Consumers working in service industries, those who earn the lowest salaries, and part-time workers are the least likely to be offered assistance saving for retirement from a recruiter. If you are one of them, here is what you can do.

Financial advisors recommend such Americans open a Roth individual retirement account. You will be able to make your own contributions for retirement with after-tax money. Young investors may also benefit from the Roth IRA as they are often in a lower tax bracket at the start of their career than they will be later.

There is no need to owe taxes in order to withdraw your retirement funds as your Roth IRA account develops tax-free. Every year you may put away a large number of funds using this account. The total consumers may save in this retirement fund is $6,000 in 2022.

The Bottom Line

Summing up, saving for a comfortable retirement is an essential monetary task for every American. Yet not many workers have access to an employer-sponsored retirement plan. It is one of the reasons why consumers can’t save enough for their golden years. There are some options for you to consider if you want to save enough funds and stop worrying about your retirement.